Did you know that if you work from home, you may be able to claim tax breaks on certain bills and expenses?

Working from home offers all sorts of benefits for employers and employees alike – employers get to cut overheads as staff aren’t onsite using the facilities and utilities, while employees get the flexibility of fitting work around other commitments, such as the school run.

Not to mention missing the rush hour commute.

And studies have found that working from home increases staff morale and productivity, another win for both employer and employee.

There could also be tax breaks in it too…

If you have to work from home

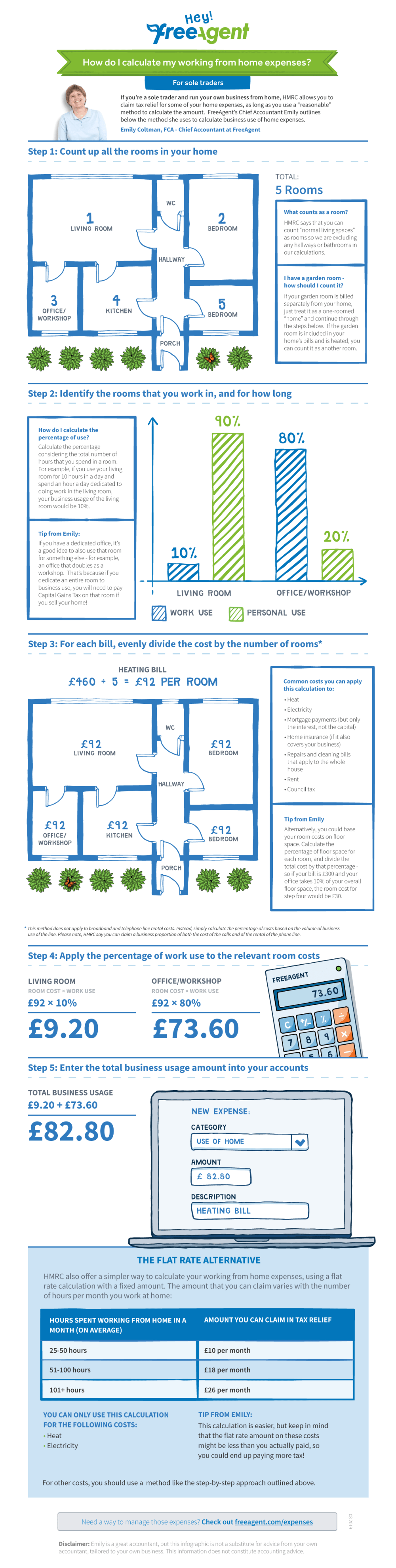

If you have to work from home on a regular basis, you may be able to get the tax back from some of your bills – but you can only claim for things to do with your work, such as business telephone calls or the extra cost of gas and electricity for your work area.

Unfortunately, you can’t claim for things that you use for both private and business use though, so getting tax relief on rent or broadband is out of the question..

And if you’re claims are no more than £4 per week (£18 per month) you don’t need to provide any records. If you’re claiming for more than £4 per week though, you’ll need to provide evidence of what you’ve spent.

If you offer to work at home

If you’ve offered to a work from voluntarily and as part of a homeworking arrangement with your employer, they may still contribute towards your expenses but don’t have to.

If your employer contributes up to £4 per week (£18 per month) towards your expenses, you won’t need to provide receipts.

If your employer contributes more than £4 per week you will need to be able to show what you’ve spent to get tax relief.

And you won’t have to pay tax or National Insurance contributions on the amount you get from your employer.

If you work at home voluntarily and your employer doesn’t contribute to your expenses, you can’t claim tax relief for what you’ve spent.

Capital Gains Tax

It was brought to our attention in the comments section that there are certain tax implications when it comes to selling your house if you designate a room in your home purely as office space, with no personal uses – there’s more on that in this article from The Telegraph.

What costs can you deduct from your taxes when you have a home office?

When using a room at home as an office, HMRC allows you to deduct two types of costs from your taxes:

Fixed costs

- Rent

- The interest on your mortgage (you cannot, however, deduct part of the capital repayments)

- Council Tax

- Insurance (unless you have separate insurance for your business, in which case you can deduct the full cost)

- Repairs and maintenance

Running costs

- Heating, lighting and electricity

- Water and sewerage

- Phone and broadband

- Cleaning

What counts as a ‘room’ you can use as a home office?

Although, HMRC is generally quite vague when it comes to defining exactly what a room is, describing it simply as a “normal living space”, the general consensus seems to be that kitchens, bathrooms and hallways don’t count as rooms. This will leave most with just the living room, the bedrooms and the room you use as an office count as rooms for tax purposes.

In theory, you can claim a deduction for two rooms, and may have to if you’re a photographer who needs a separate ‘dark room’ to develop photos. But unless this, or a similar reason, is the case, then you should only claim for one room. Don’t claim for two rooms if you just switch for a change of scenery now and then.